OTTAWA, March 6 (Reuters) – The Bank of Canada (BoC) held its key overnight rate unchanged at 5% on Wednesday as anticipated, but dashed hopes for borrowers seeking respite, citing persistent underlying inflation as a barrier to considering a reduction.

Governor Tiff Macklem emphasized the inability to schedule rate cuts, highlighting elevated core inflation metrics. Overall inflation remains at 2.9%, exceeding the bank’s 2% target.

“It would be great if this (high rates) worked faster. It would be great if it was less painful. But unfortunately, monetary policy, it does work slowly,” he conveyed during a press conference post-announcement.

The decision to maintain rates aided in lifting the Canadian dollar by 0.4% to 1.3540 per U.S. dollar, equivalent to 73.86 U.S. cents.

Following the rate announcement, data revealed a decline in the likelihood of a rate cut in April to 23%, down from 43%. Projections for a fully priced-in cut have also been postponed to July from June.

“To cut in June would be a stretch given their outlook for inflation and would likely require a more concrete pivot towards 2% in the near-term for the core measures,” stated Kyle Chapman, FX Markets Analyst at Ballinger Group.

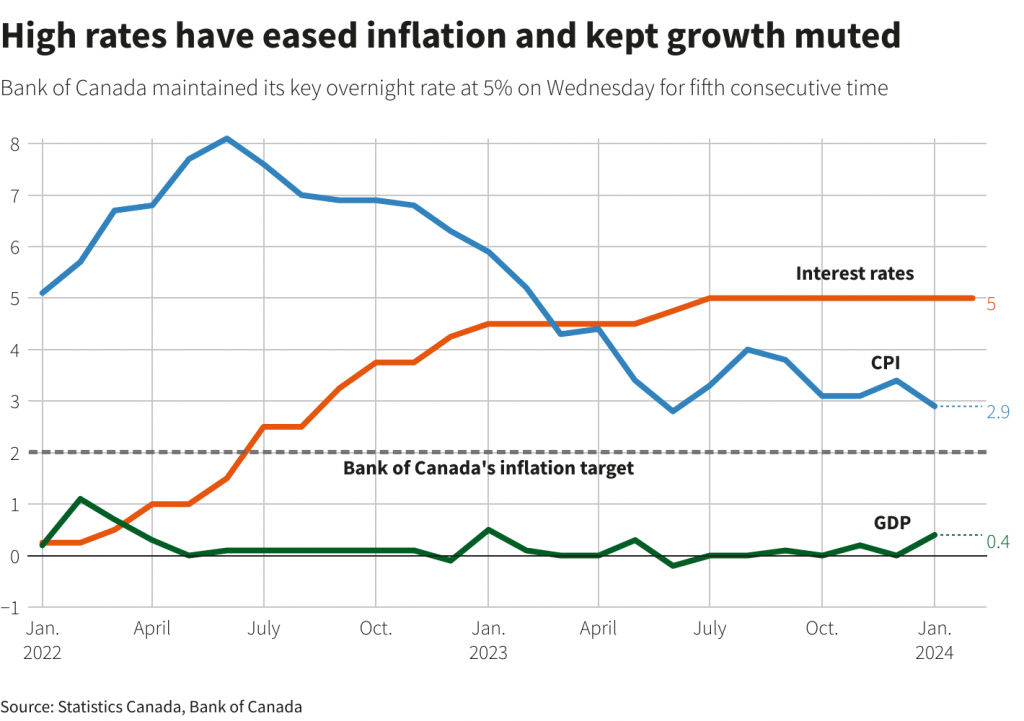

The BoC escalated rates by 475 basis points to a 22-year peak between March 2022 and July 2023, maintaining them since then for five consecutive meetings in an attempt to temper inflation without precipitating a recession.

While this strategy has curbed inflation from 8.1% in June 2022 to below 3%, upward price pressures, notably from housing and wages, persist.

Governor Macklem stressed the necessity of more time to ensure inflation gravitates towards the central bank’s 2% target. “It’s still too early to consider lowering the policy interest rate … future progress on inflation is expected to be gradual and uneven,” he affirmed in comments to reporters.

A majority of economists surveyed by Reuters last week anticipated the central bank to commence rate cuts in June. However, sentiment began shifting following Wednesday’s announcement.

“It sounds as if the Bank of Canada is very much following the Federal Reserve footsteps in expressing a need for greater confidence in the pace of disinflation,” remarked Karl Schamotta, chief market strategist at Corpay. “And that suggests that we’re going to need to see additional data releases before they pull the trigger on cutting rates.”

Inflation largely remained above 3% throughout most of last year but tapered to 2.9% in January. Macklem reiterated the bank’s anticipation for inflation to hover near 3% until mid-2024 before moderating in the latter half.

“The path back to our 2% target will be slow, and progress is likely to be uneven,” he reiterated.

“Governing Council remains concerned about the persistence of underlying inflation and we want to see a further deceleration in core inflation in the coming months,” Macklem underscored.

He echoed statements from January’s policy announcement, indicating a shift within the Governing Council’s discussions from assessing the restrictiveness of rates to deliberating their necessary duration.

“We want to give Canadians as much information as we have, but we also don’t want to give a sense of false precision,” Macklem concluded.